Financial Planning For British Expats - Navigating Opportunities

Contents

Contents

AES has advisers that have obtained the coveted Chartered Financial Planner and or Chartered Investment Adviser status. There are very few Chartered Financial Planners providing advice to expatriates outside of the UK. When working with a Chartered Financial Planner you’ll be getting advice from the highest Qualified, most experienced Financial Planner and Investment adviser possible.

The investment and Financial Planning arrangements that AES use are almost always less expensive than those which other expatriate clients are using.

AES does not accept commission payments from any provider which ensures, and guarantees, independence and transparency throughout the advice process.

The investment performance of the funds and assets that AES use are among the very best available, to any investor, worldwide. Performance for the investments that we use consistently out perform benchmarks with an objective to reduce downside volatility and risk. Again, we act completely independently from any provider that we use. No commissions, and no conflicts of interest, at any time.

-

The Importance of Financial Planning for British Expats

Moving to another country can be an exciting adventure, but it also comes with unique financial challenges. British expats must navigate unfamiliar tax systems, currency fluctuations, and varying regulations in their host countries. A well-crafted financial plan can help British expats make informed decisions, maximise their financial well-being, and avoid costly pitfalls.

-

Tax Considerations for British Expats

British expats need to understand the tax implications of living abroad to ensure that they comply with the tax laws of both the country where they reside and the UK. Failure to do so may result in unexpected tax bills, fines, and even legal consequences.

Understanding tax laws will also help expats to make informed decisions about their finances and investments, as well as plan for their future. Additionally, knowledge of tax laws will enable expats to take advantage of any tax breaks or incentives available to them, which can help to reduce their overall tax burden. Overall, understanding the tax implications of living abroad is essential for any British expat looking to manage their finances effectively and avoid any unnecessary financial difficulties. Here are some key tax considerations:

a. UK Tax Residency

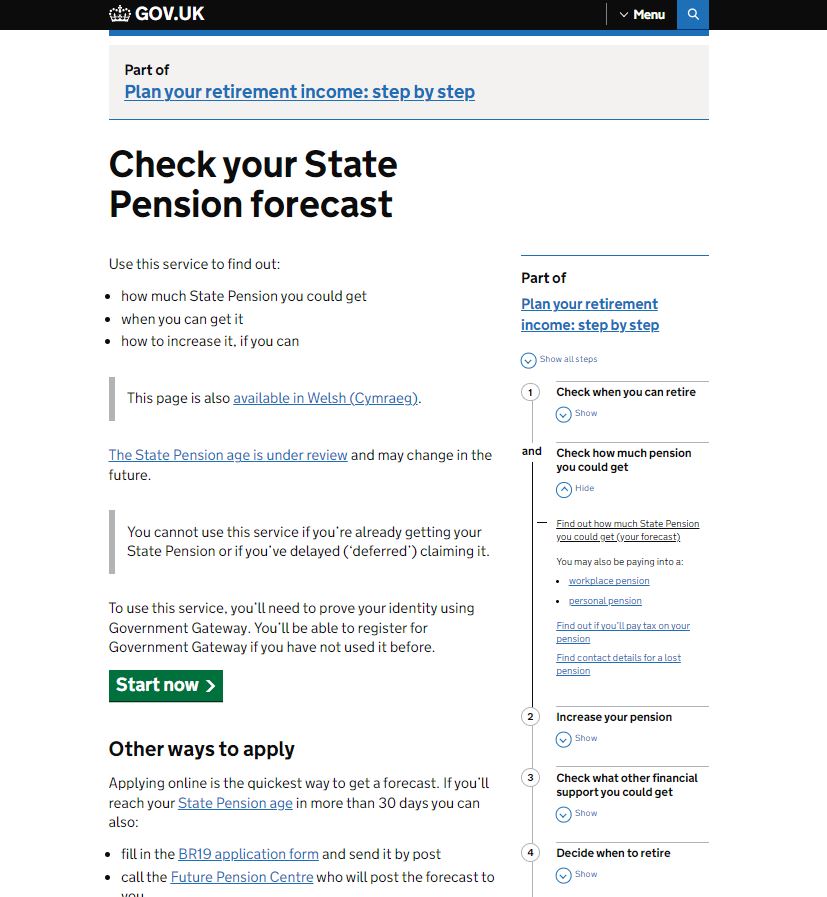

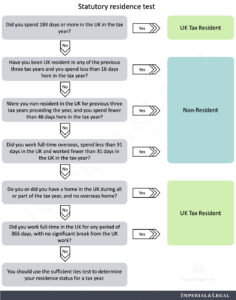

The Statutory Residence Test (SRT), a key aspect of UK tax law, plays a significant role in determining an individual’s tax residence status. A thorough understanding of the SRT and other tax considerations can help British expats avoid potential financial and legal pitfalls while living and working abroad.

The SRT comprises a set of rules that help establish an individual’s tax residency status in the UK. It is based on factors such as time spent in the country, work commitments, and personal connections. British expats must be aware of the SRT as it can have a substantial impact on their tax liabilities. Failure to comply with these rules may lead to penalties and fines, as well as unexpected tax bills.

Tax treaties between the UK and other countries also play a vital role in determining tax considerations for British expats. Such treaties help to prevent double taxation and define how income and assets are taxed in each jurisdiction. Understanding the tax treaty between the UK and the host country can assist British expats in planning their finances more effectively and avoiding tax-related complications.

Tax treaties between the UK and other countries also play a vital role in determining tax considerations for British expats. Such treaties help to prevent double taxation and define how income and assets are taxed in each jurisdiction. Understanding the tax treaty between the UK and the host country can assist British expats in planning their finances more effectively and avoiding tax-related complications.

In addition to income tax, British expats must also be mindful of other taxes that may apply to them, such as inheritance tax, capital gains tax, and the non-resident landlord scheme. A comprehensive understanding of these taxes can help expats make informed decisions about their financial assets and safeguard their interests.

Lastly, being well-versed in tax considerations enables British expats to take advantage of tax reliefs and exemptions that may be available to them. This can result in significant savings and help expats make the most of their overseas experience.

b. Double Taxation Agreements (DTAs)

Double Taxation Agreements (DTAs) are treaties between two countries that aim to mitigate the risk of an individual or a company being taxed twice on the same income. The United Kingdom has an extensive network of DTAs with other nations, ensuring that British expatriates can manage their tax liabilities more efficiently. These agreements play a crucial role in providing relief from double taxation, fostering economic cooperation, and promoting fairness in international tax matters.

For British expats, DTAs can provide significant benefits. These agreements specify the taxing rights of each country on various types of income, such as employment, pensions, and investment income. By clearly defining the tax jurisdiction, DTAs can help British expats avoid the burden of paying taxes in both their country of residence and the UK. Moreover, they may also prevent individuals from paying higher taxes due to differences in tax rates between the two countries.

DTAs often contain provisions that allow for the exchange of information between tax authorities. This cooperation facilitates the prevention of tax evasion and ensures that British expats are correctly reporting their income in both jurisdictions. In turn, this transparency can increase confidence in the tax systems of both countries.

Another crucial aspect of DTAs for British expats is the availability of tax credits. Tax credits can be applied to offset taxes paid in one country against the tax liability in another. This mechanism ensures that British expats are not unduly burdened by taxes in their country of residence, allowing them to utilise the tax benefits available in the UK.

For the very latest list of countries that the UK has a DTA in place with, please visit the UK government website gov.uk

c. Foreign Account Tax Compliance Act (FACTA)

Understanding the Foreign Account Tax Compliance Act (FATCA) is of paramount importance for British expats living and working in the United States. This legislation, enacted in 2010, aims to combat tax evasion by US taxpayers using foreign financial institutions. As a British expat, it is crucial to be aware of the implications of FATCA on your financial affairs and to ensure compliance with the relevant tax authorities.

Firstly, FATCA requires foreign financial institutions, including banks, investment funds, and insurance companies, to report certain information about their US account holders to the Internal Revenue Service (IRS). As a British expat, this means that your financial accounts held outside the US may be subject to reporting. Consequently, it is essential to understand how this reporting can impact your privacy and financial planning.

Moreover, FATCA imposes a 30% withholding tax on certain payments made to non-compliant foreign financial institutions. As an expat, your investment income and financial transactions may be subject to this withholding tax if your foreign financial institution is deemed non-compliant. It is therefore vital to ensure that the institutions holding your accounts adhere to FATCA regulations to avoid any unnecessary financial burdens.

Additionally, FATCA has led to increased cooperation between the UK and US tax authorities. This heightened collaboration means that the information shared between the two countries can result in the identification of any discrepancies in your tax filings. To avoid potential penalties and legal consequences, it is crucial to ensure you are accurately reporting your income and assets on both sides of the Atlantic.

-

Pensions and Retirement Planning

a. UK State Pension

The UK state pension is a vital aspect of retirement planning for many British citizens, providing financial support during their later years. For British expats, understanding the nuances of how the UK state pension functions while living abroad is essential to ensuring a comfortable and secure retirement. There are several key factors to consider for British expats when it comes to claiming and managing their UK state pension.

Firstly, eligibility for the UK state pension is based on an individual’s National Insurance (NI) contribution record. Typically, British citizens need at least ten qualifying years of NI contributions to receive any state pension, and 35 qualifying years to receive the full amount. British expats who have worked in the UK and have made NI contributions can generally claim the state pension when they reach the state pension age, currently set at 66 years old, regardless of their country of residence.

However, it is important to note that the country in which a British expat resides can impact their state pension. The UK has social security agreements with certain countries, including many European Union (EU) countries, which allow for the annual increase in the state pension, known as the ‘pension triple lock’. This guarantees that the pension will rise annually by the highest of the following: earnings growth, price inflation, or 2.5%. British expats living in countries without such agreements may not be eligible for these annual increases, causing their state pension amount to remain fixed.

To further support their retirement, British expats may also choose to make voluntary NI contributions while living abroad. These contributions can help fill gaps in their NI record and increase the amount they receive from the UK state pension. It is crucial for expats to assess their specific circumstances and consider whether making voluntary contributions would be advantageous for them.

b. Private Pensions

If you have a private pension in the UK, such as a personal pension or a workplace pension, you may have different options when moving abroad:

- Leave your pension in the UK: You can leave your pension invested in the UK and continue to make contributions, subject to certain rules and limits. In broad terms you are able to continue to contribute to a UK pension for five years after leaving the UK up to a maximum gross contribution of £3,600 p.a irrespective of whether you have any UK earnings. Depending on whether you are likely to return to the UK or not, in the future, you may wish to consider the impact of currency fluctuations and the possibility of unfavourable changes in tax regulations, which may affect the net pension value. It could be worthwhile considering transferring to another UK scheme which operates a greater level of flexibility for non-UK residents such as that which is offered via International SIPP providers such as IPensions.

- Transfer your pension overseas: You can transfer your UK pension to a Qualifying Recognised Overseas Pension Scheme (QROPS). A QROPS is an overseas pension scheme that meets specific criteria set by HM Revenue & Customs (HMRC) to accept transfers from UK pension schemes. This option may provide tax benefits and greater flexibility in accessing your pension.

- For British expats who decide to work in their new country of residence, contributing to a local pension scheme may also be an option. This approach allows expats to build a pension pot in their new country while still benefiting from their UK pension. However, it is essential to understand the local pension rules and tax implications to make the most of this opportunity.

-

Investment Strategies for British Expats

a. Currency Risk

Currency risks are a significant concern for British expats, as fluctuations in exchange rates can have a direct impact on the value of their investments. For expats who have investments in the UK or other countries, changes in currency values can either boost or erode their portfolio’s overall value.

The primary source of currency risk for British expats arises from the movements in the value of the British pound relative to other currencies. When the pound appreciates, the value of investments denominated in foreign currencies decreases, resulting in lower returns for the expat. Conversely, a depreciation in the pound can lead to higher returns on foreign investments. This exchange rate volatility can create uncertainty for expats who need to make regular transactions, such as repatriating funds for living expenses or converting investment income to the local currency.

One factor that can exacerbate currency risk for British expats is the potential impact of political and economic events on exchange rates. The UK’s exit from the European Union, for instance, led to significant fluctuations in the value of the pound, affecting the financial positions of many expats. Similarly, unforeseen global events, such as economic crises or geopolitical tensions, can cause sudden and unpredictable currency movements.

To mitigate currency risks, British expats should consider diversifying their investments across multiple currencies and jurisdictions. This strategy can help reduce the impact of fluctuations in the value of a single currency on the overall investment portfolio. Additionally, expats might want to consult with financial advisors or use currency risk management tools to hedge against potential losses due to exchange rate movements.

b. Offshore Investment Platforms / Offshore Investment Bonds

Offshore investments and offshore bonds have become increasingly popular among British expats seeking to diversify their investment portfolios and take advantage of favourable tax conditions. As a British expat, it is crucial to understand how these financial products can help you make the most of your money while living abroad.

Offshore investments refer to assets held in jurisdictions outside of the investor’s country of residence. For British expats, this often means investing in financial products or services provided by companies based in jurisdictions with low tax rates and a strong regulatory framework, such as the Isle of Man, Guernsey, and Jersey. One of the main advantages of offshore investments is the potential for tax efficiency, as many offshore jurisdictions have lower tax rates on income, capital gains, and inheritance tax compared to the UK.

Offshore bonds are a specific type of offshore investment that allows individuals to invest in a range of assets, such as equities, property, and fixed income securities. These bonds are issued by life insurance companies and provide a tax-efficient wrapper for the underlying investments. The main appeal of offshore bonds to British expats lies in their tax-deferral benefits. Any gains made within the bond are not subject to UK tax until the bond is encashed or a chargeable event occurs, such as the death of the policyholder or assignment of the bond.

For British expats, offshore investments and bonds can provide a degree of flexibility and control over their financial affairs. These investment vehicles allow expats to consolidate their assets in a single, easily managed location, which can be particularly useful for individuals with a diverse range of investments. Moreover, many offshore investment providers offer multi-currency options, enabling investors to mitigate currency risk by holding investments in different currencies.

-

Insurance and Protection Planning

a. Health Insurance

Health insurance is an essential aspect to consider for British expats living and working abroad. While the National Health Service (NHS) provides comprehensive healthcare coverage to UK citizens within the country, it is crucial for expats to secure their own health insurance when residing overseas.

Firstly, securing health insurance is vital for British expats to ensure that they receive timely and quality healthcare services in their host country. Many countries do not provide free healthcare or may have limitations on the services available to non-citizens. In some cases, healthcare services can be costly, and without proper health insurance coverage, expats may find themselves unable to afford the necessary medical treatments. Therefore, having adequate health insurance is not only beneficial for peace of mind but also a practical safeguard against potential financial burdens arising from medical emergencies.

There are various types of health insurance policies available to British expats. International health insurance is specifically designed for people living and working abroad, offering a wide range of coverage options, including inpatient and outpatient care, dental treatment, and maternity care. Another option is travel insurance, which typically provides coverage for shorter periods and may include medical and evacuation benefits. However, it is important to note that travel insurance is not a substitute for comprehensive health insurance, as it is primarily intended for emergencies during short-term trips.

When selecting a health insurance policy, British expats should consider several factors, such as the level of coverage required, the cost of premiums, and the flexibility of the policy. It is also essential to research the healthcare system of the host country and to understand the specific requirements and limitations that may apply to expats. Additionally, expats should verify whether their chosen policy provides coverage for pre-existing conditions and the option to include family members under the same plan.

b. Life Insurance

Life insurance is an essential financial product for individuals seeking to safeguard their family’s financial future in the event of their untimely demise. For British expats, obtaining an appropriate life insurance policy can provide a much-needed financial safety net for their loved ones, regardless of their location.

The primary purpose of life insurance is to offer a lump-sum payment to the beneficiaries upon the death of the policyholder. This payment can help cover outstanding debts, funeral costs, and provide ongoing financial support for the family. When considering life insurance, British expats should take into account the country in which they reside, the currency of the policy, and potential inheritance tax implications.

One of the challenges British expats face when seeking life insurance is finding a suitable provider. Not all insurers are willing to offer coverage to individuals residing outside of the United Kingdom. Consequently, expats may need to conduct extensive research or consult with a specialist broker to identify insurers offering appropriate policies for their unique circumstances.

In addition to this, British expats should consider the currency of their policy. While some may prefer a policy denominated in British pounds, others may opt for a policy in their local currency. Choosing a policy in the local currency can help to mitigate the impact of fluctuating exchange rates on the policy’s value, ensuring that the policy provides adequate financial protection for the policyholder’s beneficiaries.

Furthermore, British expats must be aware of potential inheritance tax implications when purchasing life insurance. Depending on the country in which they reside and their domicile status, the lump-sum payment may be subject to inheritance tax. To minimise the impact of such taxes, expats may consider placing their life insurance policy in trust, ensuring that the proceeds are paid directly to the beneficiaries without forming part of the policyholder’s estate.

c. Property and liability insurance

Property and liability insurance is an essential consideration for British expats, as it provides coverage for various risks and liabilities associated with their assets abroad. These insurances offer protection for expats’ properties and possessions, as well as financial security against potential legal claims arising from accidents or injuries sustained on their premises.

One of the main aspects of property insurance for British expats is the coverage for their homes or rental properties. Expats need to ensure that their property is protected against unforeseen incidents such as fire, theft, and natural disasters. Additionally, contents insurance can be included to safeguard personal belongings and valuables within the property. It is crucial for expats to carefully assess their coverage needs and obtain suitable insurance policies that cater to their unique circumstances, including local regulations and potential risks in their new country of residence.

Liability insurance is another critical component for British expats. This type of insurance covers legal liability for injury or damage caused to third parties, such as visitors or neighbours. For instance, if someone slips on a wet floor in an expat’s home and sustains an injury, liability insurance can help cover the costs of medical treatment and potential legal fees. It is essential for expats to have adequate liability coverage in place, as legal systems and compensation levels vary between countries and can lead to significant financial repercussions if not properly insured.

Moreover, British expats should also consider obtaining landlord insurance if they intend to rent out their property. This insurance can provide coverage for property damage, loss of rental income, and legal expenses associated with disputes between landlords and tenants. It is vital for expats to understand local tenancy laws and have appropriate insurance policies to protect their investment.

-

Estate Planning for British Expats

Estate planning is an essential aspect of personal finance, especially for British expats who have relocated overseas. It entails the careful management of one’s assets, both during their lifetime and after their passing. This process ensures that an individual’s wealth is protected and distributed in accordance with their wishes. For British expats, estate planning can be a complex matter due to the unique challenges posed by their international status. In this context, it is crucial for expats to be aware of the various elements that affect their estate planning, such as inheritance tax, domicile, and local laws in their country of residence.

a. Wills

Wills are an essential aspect of estate planning for British expats, as they help ensure that their assets are distributed according to their wishes upon their demise. The process of creating a will can be complex, particularly for those residing in foreign countries, and can involve navigating different legal systems and tax regulations. As such, it is crucial for British expats to carefully consider their will and seek professional advice to avoid any potential complications.

One of the primary concerns for British expats is determining the jurisdiction under which their will shall be executed. In many cases, a person may have assets in multiple countries, each with their own set of inheritance laws. To simplify matters, British expats should consider drafting separate wills for each jurisdiction in which they hold assets. This can help prevent conflicts between different legal systems and ensure a smooth execution of their wishes. Consult a legal professional to ensure your Wills comply with the laws of both jurisdictions.

It is also important for expats to be aware of any inheritance tax implications that may arise due to their residency status. British nationals residing abroad may still be subject to UK inheritance tax on their worldwide assets, depending on their domicile status. To mitigate potential tax liabilities, it is advisable to consult with a specialist in international tax planning, who can provide tailored guidance on the most tax-efficient way to structure a will.

In addition, expats should familiarise themselves with the local inheritance laws in their country of residence. Some jurisdictions have forced heirship rules, which dictate the distribution of assets to certain family members, irrespective of the provisions outlined in the will. Understanding these rules and working with a legal expert can help British expats craft a will that is compliant with local laws, while still reflecting their personal wishes.

Finally, it is essential to keep wills up-to-date, as personal circumstances, such as marriage, divorce, or the birth of children, can significantly impact the validity and effectiveness of a will. Regularly reviewing and updating a will ensures that it accurately reflects the testator’s intentions, providing peace of mind and security for their loved one

b. Inheritance Tax (IHT)

Inheritance Tax (IHT) is a significant concern for many British expats, as it can have a substantial impact on their estate planning and financial wellbeing. Although living abroad can offer numerous benefits, such as better career prospects, a more favourable climate, and a potentially lower cost of living, it is crucial for British expats to understand how IHT works and how it affects their financial planning.

Firstly, it is essential to understand the scope of IHT. In the UK, IHT is levied on an individual’s estate (which includes property, possessions, and money) when they pass away. The current threshold, known as the ‘nil-rate band’, stands at £325,000. Any value above this threshold is subject to a 40% tax rate, although this rate may be reduced to 36% if the deceased leaves 10% or more of their estate to charity.

A key aspect of IHT that British expats need to be aware of is, again, everyone’s favourite tax hobbyhorse, the concept of domicile. Domicile is a complex legal term that refers to an individual’s permanent home, and it has crucial implications for tax purposes. Generally, British citizens are considered domiciled in the UK, regardless of where they reside. As a result, British expats may still be subject to IHT on their worldwide assets, even if they have been living abroad for many years.

However, there are ways for British expats to mitigate their IHT liability. One option is to acquire a ‘domicile of choice’ in another country, which involves severing ties with the UK and establishing a new permanent home elsewhere. This can be a lengthy and challenging process, as it requires demonstrating a clear intention to remain in the new country indefinitely.

Another strategy to reduce IHT liability is to make use of the various exemptions and reliefs available, such as the spousal exemption or business property relief. Additionally, gifting assets during one’s lifetime can help reduce the value of the estate subject to IHT. However, the seven-year rule applies, meaning that if the donor dies within seven years of making the gift, it may still be included in their estate for IHT purposes.

Private Banking

Private banking services for have become increasingly popular in recent years, as more and more individuals choose to live and work abroad. This specialised form of banking caters to the unique financial requirements of expatriates, offering tailored solutions and personalised advice to suit their individual needs. As a British expat, it is essential to understand the advantages of private banking services and how they can enhance your financial management and overall experience abroad.

One of the main benefits of private banking is the geographical neutrality that Private Banking affords. Often accounts are provided from respected offshore banking centres, like the Isle of Man. They are, therefore, truly geographically portable – able to follow you as you move around the world and, indeed, back home.

Private banking services provide access to a vast network of global resources. Private banks typically have extensive connections with various international financial institutions, enabling expats to benefit from a wide range of investment opportunities and financial products. These may include offshore accounts, multi-currency investment funds, international mortgages, multi-currency current accounts and Visa debit cards, as well as to global stock and bond markets. Private banks are well-equipped to support clients in diversifying their investment portfolios.

As discussed above, currency management is a crucial aspect of financial planning for British expats. Private banking services often provide clients with sophisticated tools and resources to manage foreign exchange risk effectively. This can include access to multi-currency accounts, competitive exchange rates, and expert advice on market trends. By utilising these services, expats can protect themselves against currency fluctuations and ensure their wealth is preserved in the long term.

Estate and tax planning are additional areas where private banking services can be invaluable for British expats. Given the complex tax regulations that often apply to those living and working abroad, it is essential to have access to expert advice. Private banks can help clients develop efficient tax strategies, taking into account their individual circumstances and the relevant regulations in their country of residence. This can result in significant tax savings and financial benefits.

Private banking services can also facilitate access to exclusive services and perks that may not be available through traditional banking channels. This can include preferential rates on loans, mortgages, and insurance products, as well as invitations to exclusive events and experiences.

Private banking services for British expats offer numerous advantages, including personalised financial advice, access to a global network of resources, currency management solutions, and expert tax planning assistance. By opting for these specialised services, expatriates can ensure that their financial management is streamlined and tailored to their unique requirements. This, in turn, can provide peace of mind and the freedom to enjoy life abroad to the fullest, secure in the knowledge that their financial affairs are in capable hands.

-

Financial Matters for British Expats Returning Home

For many British expats, the decision to return home after living and working abroad for an extended period can be both exciting and daunting. While there is the allure of reuniting with friends and family, there are also numerous financial matters to consider in order to ensure a smooth transition back to the UK. We will consider, below, the practical steps that expats should take to prepare for their return, focusing on the temporarily non-resident rules and how they impact Capital Gains Tax (CGT), dividends and pension withdrawals.

a. Understanding the Temporary Non-resident Rules (insert picture of a banana skin: here)

It is essential for returning expats to understand the temporary / temporarily non-resident rules, as these regulations can significantly affect their tax liabilities. These rules are designed to prevent individuals from leaving the UK to become non-resident, disposing of assets while abroad to avoid CGT or income tax, and then returning to the UK shortly afterwards. An individual is considered temporary non-resident if they have been a UK resident for four of the seven tax years preceding their departure and return within five years.

Capital Gains Tax (CGT) Implications

When it comes to CGT, the temporary non-resident rules mean that any gains made on the disposal of assets during an individual’s period of non-residence, acquired during the previous period of UK residency, will be subject to UK tax upon their return. Assets acquired and disposed of during the non-residence period are normally excluded, however, this is not always the case.

There are, therefore, some exceptions to this exclusion which many could find themselves falling foul of (insert banana skin pic again). Generally speaking, where assets are acquired after the period of non-sole UK residence begins, and those assets have a connection with the earlier period of sole UK residence, they will not be excluded and will thus be taxable upon return to the UK. The rules are complex therefore professional guidance should be sought to understand whether you may have a sustained liability for capital gains tax on assets disposed of whilst non-UK resident.

It is important to keep records of any assets sold while abroad, as they may be required to report these gains upon their return to the UK.

One notable exception to the temporarily non-resident rules for CGT is the disposal of an individual’s main residence. Under the Principal Private Residence (PPR) relief, any gains made on the disposal of a main residence are exempt from CGT, provided certain conditions are met. Expats should consult with a tax advisor to determine whether their property sale may qualify for this relief.

Close Company Dividend Income & Chargeable Event Gains on Life Assurance Policies

Dividends received by expats while they are temporary non-resident will generally not be subject to UK tax. However, close company dividends and chargeable event gains on life assurance policies will be taxable upon a return to the UK in the tax year of return. It is essential to keep records of any dividends or life policy gains received while abroad, as they may need to be reported on a UK tax return. Additionally, individuals should be aware that any foreign tax paid on these dividends may be eligible for a Foreign Tax Credit, which may be used to offset their UK tax liability.

Pension Withdrawals and Taxation

Pension withdrawals made by expats while they are non-resident may not be subject to UK tax at that point. However, upon returning to the UK, these withdrawals may become taxable dependent upon whether they are considered to be a ‘relevant withdrawal’. The rules as to what constitutes a ‘relevant withdrawal’ can be generally boiled down to income being withdrawn, rather than any eligible pension commencement lump sum, with a value above £100,000.

As above, these anti-avoidance rules are designed to stop someone hop-skipping their way over to the UAE, fully surrendering their UK pension and then returning to the UK having paid no income tax on withdrawals. If they are considered to have been temporarily non-resident for UK tax, then they will be taxed on that pension income upon their return.

Again, these rules are complex therefore if you feel that you will be subject to the rules relating to temporary non-residence, make sure that you consult with a qualified Financial Adviser or tax specialist to understand what your liabilities will be.

b. Pensions and Investments

Review your pension arrangements and investments to determine whether it’s necessary to make any changes upon your return. For example, you may need to transfer your QROPS back to a UK pension scheme or consolidate your pension arrangements.

British expats should review their investment portfolios when returning to the UK. The investment strategies that worked well in their host country may not be appropriate in the UK market. Currency fluctuations, changes in risk tolerance, and differences in tax treatment are just some of the factors that can impact an expat’s investment approach. Expats should reassess their financial goals and risk appetite, and consider diversifying their portfolios to accommodate the unique challenges and opportunities of the UK market.

Preparing for the Financial Transition

Practical steps that expats should take to prepare for their financial transition back to the UK:

- Consult with a tax / financial advisor: Engaging the services of a tax advisor experienced in expatriate tax matters can help individuals navigate the complexities of the temporarily non-resident rules and other tax implications associated with returning to the UK. A tax advisor can provide guidance on potential tax liabilities and ensure that all necessary documentation is prepared and filed correctly.

- Review investments: Prior to returning to the UK, expats should review their investment portfolios to ensure they are tax-efficient and compliant with UK regulations. This may involve disposing of certain investments or restructuring their portfolios to minimise tax liabilities.

- Establish a UK bank account: Expats should consider opening a UK bank account before returning, as this can make the process of transferring funds and managing finances easier upon their arrival. Many banks offer specialised services for expats, including multi-currency accounts and tailored financial advice.

- Obtain a National Insurance Number (NINo): Expats who have been abroad for an extended period may need to apply for a new NINo or reactivate their existing one. This number is required for tax and social security purposes and should be obtained before starting employment or self-employment in the UK.

- Inform relevant authorities: Upon returning to the UK, expats should notify HM Revenue & Customs (HMRC) of their change in residence status. They may also need to inform other relevant authorities, such as their local council, the Driver and Vehicle Licensing Agency (DVLA), and the electoral register.

- Update insurance policies: Expats should review and update their insurance policies, including life, health, and property insurance, to ensure they have adequate coverage upon their return to the UK.

- Develop a financial plan: Creating a comprehensive financial plan can help expats manage their finances upon returning to the UK. This may involve setting financial goals, creating a budget, and developing a savings and investment strategy.

Navigating the complexities of expatriate financial planning can be challenging. Engaging a qualified financial advisor with experience in serving British expats can help you make informed decisions and optimise your financial well-being abroad.

When selecting a financial advisor, consider their expertise, qualifications, and experience in addressing the unique challenges faced by British expats. Look for advisors who hold relevant certifications, such as the Chartered Financial Planner designation. Additionally, you should verify their registration with the relevant regulatory bodies, such as the Chartered Insurance Institute, Chartered Institute for Securities & Investment or their home country regulator such as the Financial Conduct Authority (FCA) in the UK.

Conclusion

Expatriate financial planning for British expats requires careful consideration of various factors, such as taxation, pensions, investments, insurance, and estate planning. By addressing these key concerns and working with a qualified financial advisor, British expats can successfully navigate the challenges of living abroad and achieve their long-term financial goals.

Financial Planning & Investment Advice for Expats. IFA for Expats from UK Qualified Advisers. QROPS, Investments, Insurance, IHT, Retirement & Estate Planning.

Please contact us today for a fee-free informal discussion about how we can help you.