IPensions International SIPP Review

If you’ve been recommended an Ipensions SIPP, contact us today for a fee-free initial meeting to understand what we can offer you. As Chartered Financial Planners we focus on reducing costs and maximising investment performance using the best performing funds available.

Introduction

Ipensions International SIPP Review. First of all, it would probably be useful to outline exactly what an ‘International’ SIPP is (self invested personal pension) as compared to a standard, UK SIPP. In essence, there isn’t any technical difference between the two, however, providers of International SIPP’s have a model of working that actively supports clients who are resident outside of the UK. For many standard UK SIPP providers, they will no longer their client’s to actively manage their SIPPs when they become resident outside of the UK in the future.

Therefore, an international SIPP (Self-Invested Personal Pension) is a type of personal pension scheme that allows individuals to manage and invest their retirement funds in a more flexible manner. SIPPs are particularly popular in the United Kingdom, and an international SIPP is an extension of that concept, catering to expatriates or individuals with international investment interests.

Some benefits of an international SIPP may include:

- Tax efficiency: International SIPPs (like standard SIPPs) offer tax advantages, such as tax-free growth on investments and the ring fencing of assets from future inheritance tax charges.

- Currency flexibility: They may allow for investments in multiple currencies, which can be beneficial for individuals who reside outside of the UK, either temporarily or permanently.

- Investment flexibility: International SIPPs can offer a broader range of investment options compared to traditional pension schemes, enabling individuals to build a more diverse portfolio.

- Portability: For expatriates or individuals who move between countries, an international SIPP may provide more portability and continuity in retirement planning.

However, it’s essential to be aware of the fees and charges associated with an international SIPP, as they can be higher than those of a standard SIPP or other pension schemes. Additionally, it is crucial to research the regulations and tax implications in the countries where you hold investments to ensure compliance with local laws.

IPensions International SIPP

iPensions is an international SIPP (Self-Invested Personal Pension) provider that has been offering its services under the Ipensions branding since 2018 (formally known as the Momentum SIPP). As a leading SIPP provider catering to clients worldwide, iPensions has grown to manage over £2 billion in assets. This review will provide an in-depth look into iPensions’ offerings, performance, fees, customer service, and ease of use.

Overview

iPensions offers a comprehensive and flexible SIPP solution to help clients build a retirement portfolio that suits their individual needs. With access to over 4,000 investment options, including equities, bonds, funds, and exchange-traded funds (ETFs), iPensions has attracted over 25,000 clients from 100 different countries.

The international SIPP from iPensions is designed for expats and non-UK residents who wish to benefit from UK pension tax relief and investment flexibility. iPensions is regulated by the Financial Conduct Authority (FCA) in the UK, ensuring a high level of security and compliance for its clients.

Investment Options and Performance

As mentioned earlier, iPensions offers access to more than 4,000 investment options across multiple asset classes. Some of the most popular investment options available through iPensions include:

- Equities: Over 1,500 individual stocks from 23 different countries, including the United States, the United Kingdom, and Germany.

- Bonds: A selection of more than 500 government and corporate bonds from various countries.

- Funds: Access to over 1,200 funds, including actively managed funds, passive index funds, and specialist funds.

- ETFs: More than 800 exchange-traded funds covering various indices, sectors, and commodities.

iPensions provides access to a range of risk-rated model portfolios, designed for different investment objectives, in addition to indvidually managed portfolios, managed by professional investment advisers.

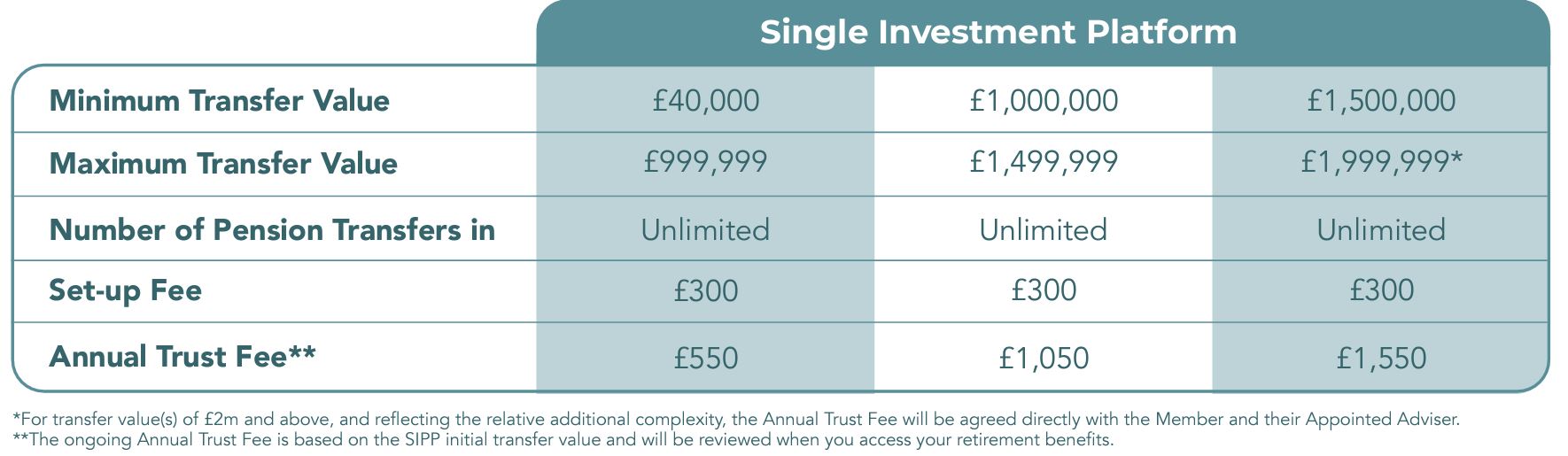

Fees and Charges for the Adviser SIPP (most popular of Ipensions offering)

iPensions offers a transparent fee structure that aims to be competitive in the SIPP market. The fees are categorised into three main areas: administration fees, transaction fees, and annual management charges (AMCs).

- Set-upfee: IPensions charges a one-time setup fee of £300 and an annual administration fee of £550, covering the core services such as account maintenance and reporting. For clients with assets above £1 million, the annual administration fee is increased to £1,050

- Transfer Out Fees: IPensions charge no fee to transfer to another Ipensions pension schemes. To other UK registered pension schemes the fee is £500, to a recognised Overseas Pension Scheme £1,000

- Annual management charges (AMCs): The AMCs are applied to the assets under management and vary depending on the investment options chosen. For example, passive index funds typically have lower AMCs (0.1%-0.3%), while actively managed funds and specialist funds may have higher charges (1%-2%).

In addition to these charges, there are additional fees for specific services, such as setting up benefits, income drawdown.

Customer Service

iPensions provides support through multiple channels, including phone, email, and live chat. Their customer service team is available Monday to Friday from 9 am to 5 pm (GMT). Based on customer reviews, iPensions has a Trustpilot rating of 4.5 out of 5 stars, indicating a high level of satisfaction with their customer service. Many clients praise the responsiveness and professionalism of the support team, while others appreciate the personalised attention they receive when dealing with their pension queries.

Ease of Use

iPensions offers an intuitive online platform, available on desktop and mobile devices, for clients to manage their pension investments. The platform provides access to comprehensive account information, real-time investment valuations, and detailed performance reports. Clients can execute trades, rebalance their portfolios, and make additional contributions with ease.

The iPensions platform also features a suite of tools and resources to help clients make informed investment decisions. These include research reports, market news, and educational content on various investment topics. Additionally, iPensions offers a risk assessment tool that enables clients to determine their risk tolerance and select an appropriate investment strategy.

Pension Flexibility

iPensions’ international SIPP is designed with flexibility in mind, allowing clients to tailor their retirement plans according to their unique circumstances. Clients can start drawing benefits from their pension at age 55 (subject to change based on UK regulations) and have the option to take a tax-free lump sum of up to 25% of their pension value.

iPensions offers multiple options for clients to access their pension income, including:

- Flexi-access drawdown: Clients can take a variable income from their pension, adjusting the amount as needed, while the remaining funds continue to be invested.

- Annuity purchase: Clients can use their pension to buy a guaranteed income for life from an insurance company.

- Uncrystallised funds pension lump sum (UFPLS): Clients can take a one-off lump sum from their pension, with 25% being tax-free and the remaining 75% subject to income tax.

Conclusion and Next Steps

Ipensions is an attractive solution for expats and internationally mobile individuals seeking a flexible and tax-efficient pension platform. With its wide range of investment options, currency flexibility, and competitive fee structure, Ipensions can help clients optimise their pension planning and achieve their long-term financial goals.

iPensions has established itself as a reputable and reliable international SIPP provider, catering to the diverse needs of expats and non-UK residents. With a wide range of investment options, competitive fees, excellent customer service, and an easy-to-use platform, iPensions offers a comprehensive solution for building a flexible retirement plan. Their strong performance and commitment to transparency make iPensions a compelling choice for individuals seeking an international SIPP provider.

For those interested in exploring their international SIPP options, AES, UK qualified Chartered Financial Planners, offer a fee-free initial meeting to discuss all of your international SIPP needs. Our team of experts can help you assess whether Ipensions is the right choice for your unique circumstances, and guide you through the process of transferring your pension, if appropriate.

To schedule a fee-free initial meeting with AES, simply reach out via our or contact form, phone or email. Experienced financial planners are ready to help you navigate the complex world of international pensions, ensuring that you make informed decisions to secure your financial future.

When it comes to managing your UK pension as an expat, having a trusted, reliable, and effective solution is paramount. In the complex world of finance, iPensions and AES have emerged as leaders in international pension management, working seamlessly together to provide UK expats with an excellent international Self-Invested Personal Pension (SIPP) solution for their UK pension transfers. Their partnership has brought peace of mind and financial security to thousands of satisfied customers around the globe.

IPensions (formally Momentum), an international SIPP provider, has been in the pension industry for more than a decade, establishing themselves as a trusted partner for UK expats seeking to transfer their pensions overseas. With a focus on flexibility, transparency, and superior customer service, iPensions has become synonymous with quality and reliability in the international pension market. Their commitment to innovation and adapting to the ever-changing landscape of global finance makes them a favorite among UK expats looking for efficient and cost-effective pension solutions.

AES, a global wealth management firm with a presence in more than 70 countries, specialises in providing tailored financial advice and services to expats. With their extensive knowledge of international tax regulations, investment strategies, and pension planning, AES has become a go-to resource for UK expats who are concerned about their financial futures. The company’s dedication to ethical and transparent practices has earned them a stellar reputation, making them a natural partner for iPensions.