You would have noticed, over the last few weeks, a bit of a rally in most of the stock markets.

This is not, I’m afraid, a product of an improving global Macro picture (though there have been some negligible improvements in US data – of a ‘subject to change’ kind – i.e. large portion of the 163,000 new non-farm jobs reported are temporarily and likely to be gone soon) more a symptom of a range bound, hedge fund driven, equity market.

Continuation in the current rally is brought further into question as the volume has been decreasing rather than increasing as the markets have risen. This shows unequivocally that there is not widespread participation in the market – ‘thin’ participation means that the foundations for the rally are week and much more liable to capitulation.

Continuation in the current rally is brought further into question as the volume has been decreasing rather than increasing as the markets have risen. This shows unequivocally that there is not widespread participation in the market – ‘thin’ participation means that the foundations for the rally are week and much more liable to capitulation.

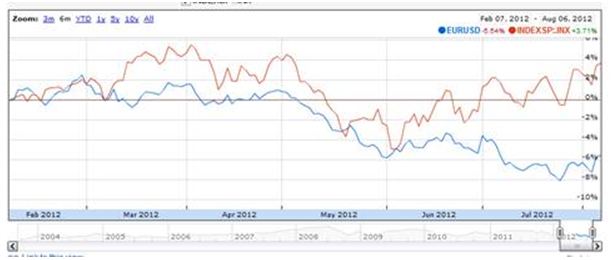

As a final point for uncertainity over the recent rally, the ‘risk on’ currency pair of EUR/USD has decoupled from it’s recent correlation to the stock market which represents further evidence for the fickle nature of the recent rally.

As a final point for uncertainity over the recent rally, the ‘risk on’ currency pair of EUR/USD has decoupled from it’s recent correlation to the stock market which represents further evidence for the fickle nature of the recent rally.

We may see further continuation in the rise of the equity markets this month, however, as we move into one of the worst months of the year for the markets, September, that is when I think we’ll see markets sell off again.

We may see further continuation in the rise of the equity markets this month, however, as we move into one of the worst months of the year for the markets, September, that is when I think we’ll see markets sell off again.