How Can I Reduce my Liability for Inheritance Tax? Dodging the Inheritance Tax Bullet: IHT Mitigation Strategies for UK Residents and Non-Residents.

An Amusing Inheritance Tax Tale

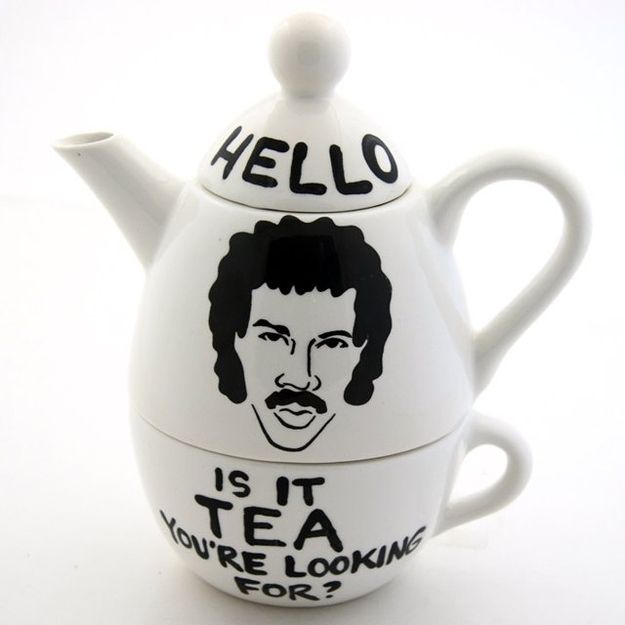

Once upon a time, a wealthy British entrepreneur named Sir Pennywise decided he had enough of the UK’s steep inheritance tax. So, he hatched a plan. Sir Pennywise would divide his fortune among his children and grandchildren, then move to a tropical island paradise to live out his days. However, he had a soft spot for his vast collection of antique teapots. Unwilling to part with them, he devised a creative solution: he would hold an annual teapot exhibition and charge a nominal fee for entry, effectively transforming his cherished collection into a business asset. As a result, he managed to secure Business Relief on his teapot s, saving them from the clutches of the IHT. And so, Sir Pennywise continued to sip his tea in peace.

s, saving them from the clutches of the IHT. And so, Sir Pennywise continued to sip his tea in peace.

-

Understanding UK Inheritance Tax

Inheritance tax (IHT) in the UK is levied on the estate of a deceased person, including property, money, and possessions. The current tax-free allowance, also known as the “nil-rate band,” is £325,000 per person. Beyond this threshold, the estate is subject to a 40% tax rate. However, there are various exemptions and reliefs available, which can help reduce your IHT liability.

-

Utilising the Spousal Exemption

One of the most straightforward ways to reduce IHT liability is to take advantage of the spousal exemption. Married couples and civil partners can transfer an unlimited amount of assets to each other without incurring IHT. Additionally, any unused portion of the nil-rate band can be transferred to the surviving spouse, effectively doubling the allowance to £650,000.

-

Maximising the Residence Nil Rate Band (RNRB)

The Residence Nil Rate Band (RNRB) is an additional IHT allowance available when a main residence is passed to direct descendants, such as children or grandchildren. The RNRB is currently £175,000 per person, which can be added to the standard nil-rate band. Like the regular nil-rate band, any unused RNRB can be transferred to a surviving spouse, increasing the potential IHT-free allowance to £1 million for a couple.

-

Gifting Assets During Your Lifetime

One effective method to reduce your IHT liability is to make gifts during your lifetime. If you survive for seven years after making the gift, it will no longer be considered part of your estate for IHT purposes. This is known as the “seven-year rule.” However, certain gifts are immediately exempt from IHT, such as:

- Annual exemption: You can give away up to £3,000 worth of assets each tax year without it being added to your estate.

- Small gifts: You can make an unlimited number of small gifts up to £250 per person per tax year.

- Gifts for weddings or civil partnerships: You can give up to £5,000 to your child, £2,500 to your grandchild or great-grandchild, and £1,000 to anyone else.

- Gifts to charities, political parties, and some national institutions.

-

Establishing a Trust

Setting up a trust can be a useful tool for managing and protecting your assets while potentially reducing IHT liability. By transferring assets into a trust, you effectively remove them from your estate, and they are no longer subject to IHT. However, the type of trust you establish, the assets involved, and the timing of the transfer can impact the tax implications. It is essential to consult a financial adviser or solicitor to determine the most suitable trust structure for your circumstances.

-

Investing in Business Property Relief (BPR) Qualifying Assets

As our amusing IHT story illustrated, Business Relief is a valuable tool for reducing your IHT liability. Investing in BPR-qualifying assets, such as shares in certain unlisted companies or qualifying AIM-listed companies, can provide relief from IHT. After holding these assets for at least two years, they become 100% exempt from IHT. This strategy can be an effective way to reduce your IHT liability while also diversifying your investment portfolio. However, it is crucial to bear in mind that investments in smaller companies can be higher risk, and it is essential to seek professional advice before making any investment decisions.

-

Taking Out Life Insurance

Taking out a life insurance policy can help to cover the IHT bill your beneficiaries may face. By placing the policy in trust, the payout will not form part of your estate and will not be subject to IHT. The beneficiaries can then use the proceeds to pay the IHT bill, reducing the financial burden on them. It is important to consult a financial adviser to help you choose the right policy and structure it appropriately.

-

Leaving a Charitable Legacy

Leaving a portion of your estate to charity can not only benefit a cause you care about but also help to reduce your IHT liability. Bequests to registered charities are exempt from IHT, and if you leave at least 10% of your net estate to charity, the IHT rate on the remainder of your estate is reduced from 40% to 36%. This can be a valuable strategy for those who wish to support charitable causes while reducing their IHT bill.

-

Considering Domicile Status

Non-UK domiciled individuals (non-doms) have different IHT rules compared to UK residents. Non-doms are only liable for IHT on their UK-based assets, while their overseas assets are exempt. If you are a non-dom, it is essential to seek advice on structuring your assets to minimise your IHT liability. For UK residents considering a move abroad, acquiring non-dom status may help to reduce IHT exposure, but the process of changing domicile status can be complex and requires careful planning.

-

Pension Planning

Ensuring your pension is structured correctly can also help minimise your IHT liability. Defined contribution pensions, such as a self-invested personal pension (SIPP) or a stakeholder pension, can be passed on to your beneficiaries free of IHT, provided certain conditions are met. It is important to keep your nominated beneficiaries up to date and review your pension arrangements regularly to ensure they are optimised for IHT planning purposes.

Seek Professional Advice

Reducing your IHT liability requires careful planning and a thorough understanding of the tax rules and available exemptions. It is essential to seek professional advice from a financial adviser or solicitor experienced in estate planning and IHT mitigation. They can help you assess your situation, identify the most effective strategies for your circumstances, and ensure that your plans are executed in a legally compliant manner.

Conclusion

Inheritance tax can have a significant impact on the wealth you pass on to your loved ones. However, there are numerous strategies available to UK residents and non-residents to reduce their IHT liability. By understanding the available exemptions, gifting assets, setting up trusts, investing in BPR-qualifying assets, and seeking professional advice, you can help to ensure that more of your wealth is preserved for your beneficiaries, without resorting to elaborate schemes like our aristocratic friend at the beginning of this article.