High Performing, Sustainable Investing for Expats & Internationals

According to a recent UN report, an estimated $2.4tn (£1.7tn) investment a year is needed to meet global temperature goals.

According to Morningstar, ESG funds attracted inflows of €233bn (£200bn) during 2020, almost double the figure for 2019. The first quarter of 2021 witnessed a further inflow of a €120bn, representing 51 per cent of overall European fund flows.

I was always a bit sceptical about ESG / Sustainable investing. Always felt a bit ‘tree huggy’ to me. However, when you boil it down, ESG investing makes total sense. When it’s deconstructed to it’s most basic form, ESG simply encapsulates good risk management. Good risk management in respect to the way in which the organisation interacts and transacts with it’s key stakeholders – with no bigger stake holder than the climate itself.

As Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said in a recent FT article:

“Businesses are increasingly facing pressure from regulators, society and government, which forces them to think longer term and be mindful of the planet, their employees and the way they make money. Respond well and they will thrive, but, fail to engage, and they could face fines, scandal or bankruptcy.”

Interest in ESG funds is breaking new records, understandably so.

The question is, therefore, can you have your ‘cake and eat it’ when it comes to making investments in ESG funds and generating market beating returns. The short answer is yes, you can.

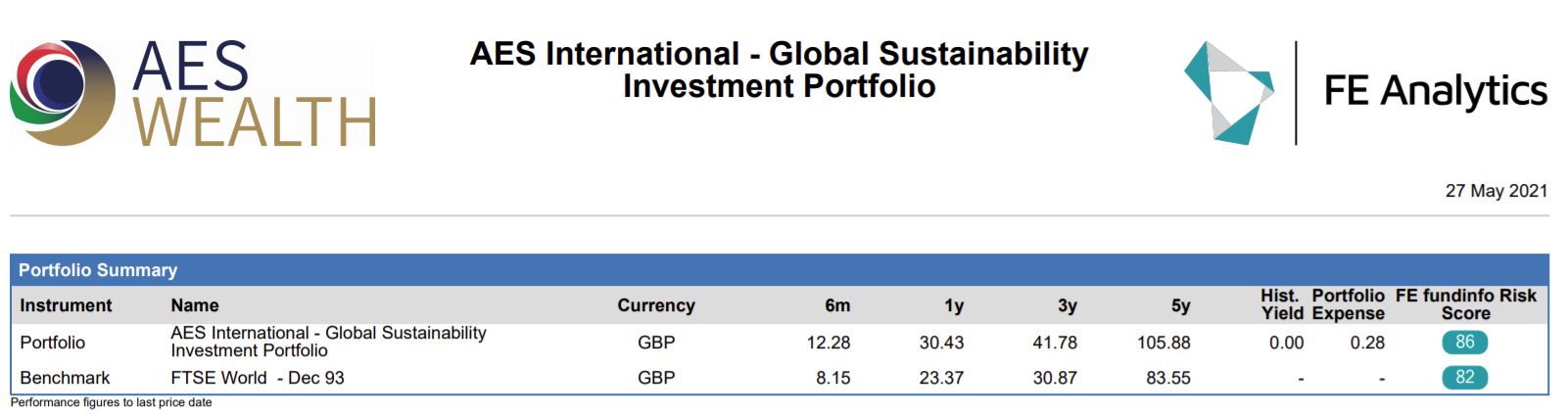

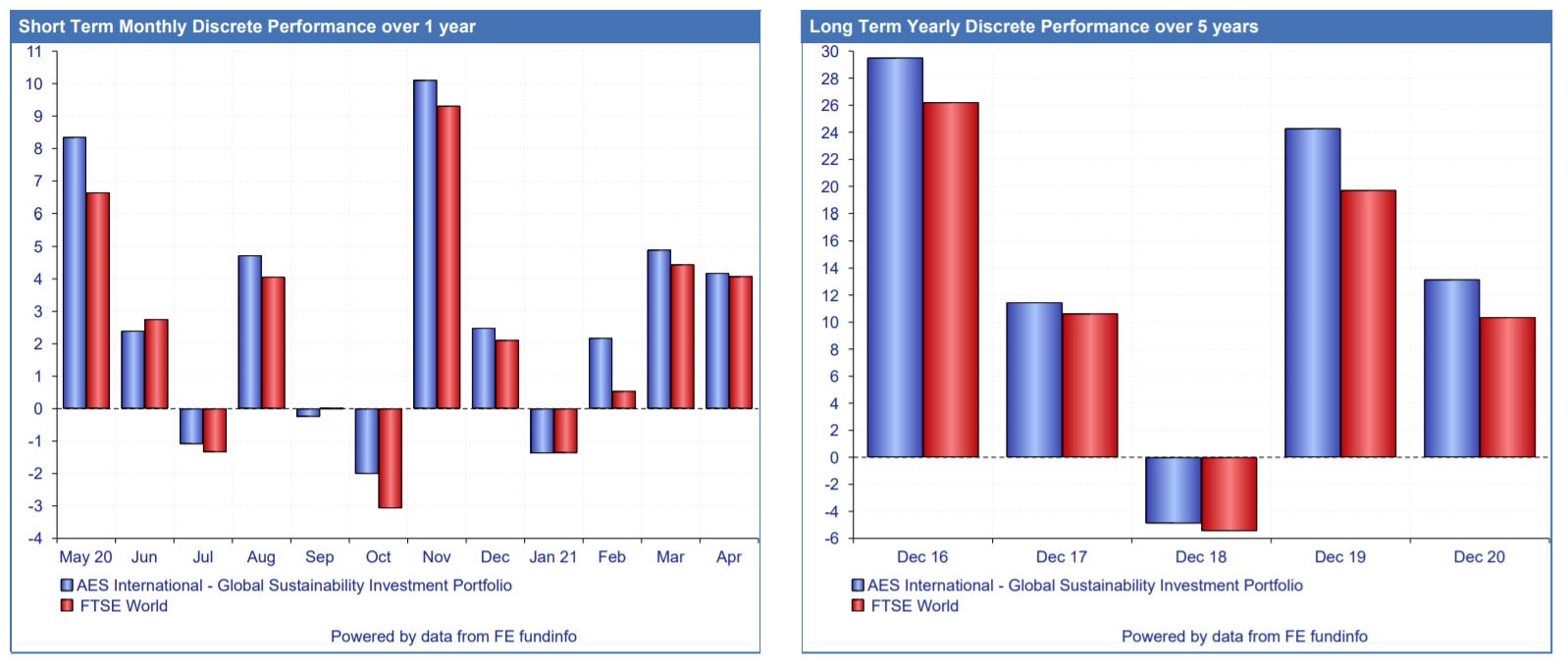

Past performance can’t be used as a guide to future performance, however, the returns that our Global Sustainability Portfolio have generated over the last five to eight years are extremely robust.

What’s even more interesting is that when the Global Markets have fallen, our Global Sustainability Portfolio has fallen less than the standard Global Stock Market:

Beating the standard Global Markets benchmark across all time frames for the last eight years:

If you’re an expatriate or an international investor and interested in exploring ESG, Sustainable or Ethical Investing options for your money, contact us today to understand the options available to you.

With thousands of clients all over the world, we’re fee based, non-commission advisers guaranteeing that we’re working in your best interests now, and always.