By Russell Hammond APFS MSCI

So, you’ve heard about diversification but what’s this about Diversification Benefit? Well, read on to find out why your portfolio should have it and why you (your adviser) should be monitoring it.

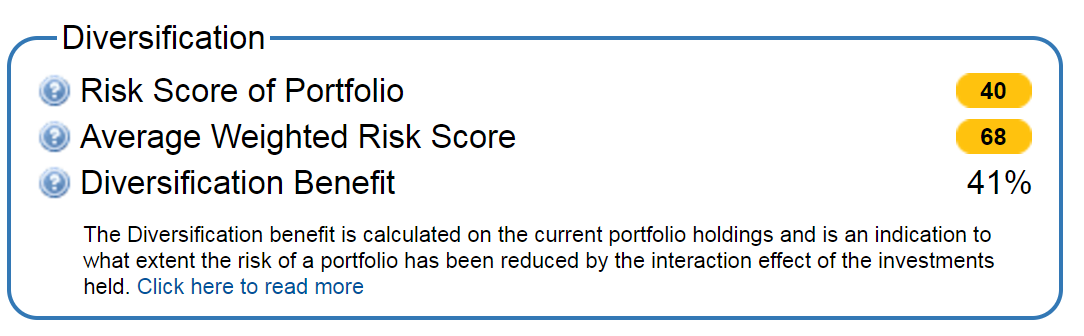

So, Diversification Benefit is calculated on current portfolio holdings and is an indication to what extent the risk of your portfolio has been reduced by the interaction effect of the investments held. Generally speaking, we should look to maximise diversification as a form of insurance when we sustain uncertainty with how markets are going to react, in the short to medium term, and thus where we want to spread our risk as much as possible in order to avoid large drawdown events.

An investor would look to have low levels of diversification when they have a high conviction in the way markets are going to perform and want to build a portfolio to exploit this scenario. A portfolio with a low level of diversification could experience a large fall in value if the investor’s predictions prove incorrect. We saw a real life example of this in 2008 when a lot of so-called ‘Cautious’ portfolios lost 40% overnight as a consequence of being poorly diversified and exposed to just one or two difference asset classes.

Any portfolio that holds investments that are not perfectly correlated will experience some levels of diversification, the lower the correlation the higher the diversification. By choosing uncorrelated investments (i.e. investments that behave differently) you will be able to reduce your unsystematic risk, creating a portfolio with far lower risk than the sum of its parts (Average Weighted Risk Score).

So, in other words, if we take one of my client’s portfolios as an example, although the average risk score for the portfolio is 68 (out of 100), the high level of diversification between assets means that the risk is reduced, by41%, to provide a final risk score output of 40. Therefore, he has the benefit of being able to generate a higher return by being invested in ‘risk’ assets, however, his risk is reduced by virtue of the fact that some of the investments move in the opposite direction to one another.

Russell is a Chartered Financial Planner and Chartered Investment Adviser. Operating on a fee-only basis, Russell has set the standard for superior international wealth management advice.